The Wall Street Journal reports that Alaska Airlines has reached a deal to purchase Virgin America. The big news is the price paid.

Alaska Air Group Inc. said Monday morning that it had reached a deal to buy Virgin America Inc., winning a frenzied bidding war with rival JetBlue Airways Corp. The parent company of Alaska Airlines said it would pay $57 a share for Virgin, a 47% premium to Friday’s closing price, representing a total equity value of $2.6 billion. The Wall Street Journal had reported Sunday that Alaska won the bidding contest for Virgin, whose shares have risen lately on takeover speculation.

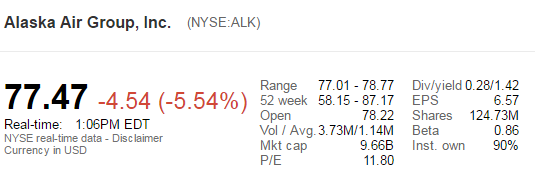

And investors are responding with a little bit of disapproval as well, with Alaska Airlines stock down around 5.5% at 10am Pacific.

I am a little concerned that Alaska is paying a significant premium simply to gain gate space and landing slots at a few different airports, namely San Francisco. They are making the purchase at a time when Delta is still trying to grow their new Seattle operation and encroach further into Alaska’s dominant hub, yet they seem unfazed. The Alaska premium product is definitely not cut out to go head to head with some of the other premium transcontinental products and Virgin’s product is showing its age. How does Alaska plan to compete with better products on some of the more lucrative transcon markets (SFO/LAX-NYC, SFO-BOS)?

And all of this without taking into account two very different customer loyalty groups. Virgin is considered sleek and hip, while Alaska Airlines has a loyal following in the Pacific Northwest and Alaska. Merging those two cultures together while not losing customers will be key for Alaska to succeed. I wonder if the Alaska Airlines management team has a plan in place for doing just that or if they are going to call in the consultants to try and sort it out.

Lastly is the two very different airplane fleets. Virgin America operates an all Airbus A320 and A319 fleet while Alaska Airlines is Boeing 737s for their mainline operations. During the analyst call this morning it was mentioned that the Virgin America Airbus leases start expiring in 2020, so for the next few years, there will be a mixed fleet. The one possibility is that Alaska will use the Airbus fleet up and down the west coast since their capacity is a little less than what the 737s can hold and Alaska could run more frequencies to make up for that.

My general sentiment is that I had thought JetBlue would win the bidding war and build a larger west coast presence. This seems like a generally risky move for Alaska who up until this point has not needed financing to operate and they have grown very organically through the years. I worry that biting off more than they can chew could come back to haunt them in the next few years. I hope I am wrong, but the true test will be whether or not they are able to stay entrenched at Seattle-Tacoma International.